Businesses need to calculate the value of their inventory and cost of goods sold at the end of each period to determine their profit or loss. To calculate these, businesses need to keep track of any changes in their inventories during the year. There are two main types of inventory systems that are widely used, periodic inventory system and perpetual inventory system. In this article, we will explain the periodic inventory system and give some example to demonstrate how it works. So what is periodic inventory system?

Definition

Periodic inventory system is a mechanism to calculate the inventory and cost of goods sold of a business. The periodic inventory system performs stock valuations at regular intervals of time. These stock valuations are carried out by taking physical inventory counts of the stock at the end of every specified period.

The periodic inventory system is a contrasting mechanism to the perpetual inventory system. Under the perpetual inventory system, inventory is updated every time inventory is dispatched or received. In periodic inventory system, inventory is only updated at the end of the specified period. Any stock received during the period is recorded in a temporary purchases account.

At the end of the period, the physical count of the inventory is taken and the value of the closing inventory is calculated using different methods such as First-In-First-Out (FIFO), Last-In-First-Out (LIFO), Average Weighted Cost, etc. Using this closing inventory, the business can then calculate its cost of goods sold. The cost of goods can be calculated using the formula below:

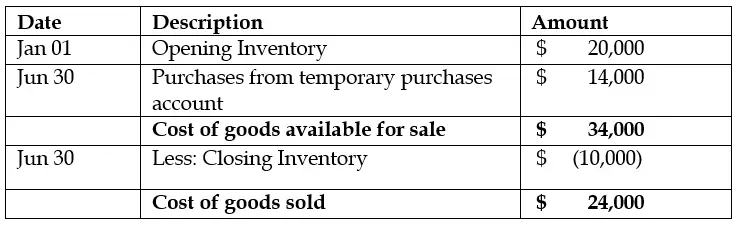

Cost of goods sold = Opening Inventory + Purchases – Closing Inventory

Calculating Inventory Using Periodic Inventory System

To calculate the closing inventory for a period, a physical count of inventory is taken. Furthermore, data about inventory received is obtained from the temporary purchases account. Once all data is available, the purchases for the period are added to the opening balance of inventory, which is the closing inventory of the previous period. This sum of opening inventory and purchases is known as the cost of goods available for sale.

Any closing inventory, which was physically counted is given a valuation. This valuation can be based on different valuation techniques mentioned above. Once the valuation of closing inventory is determined, it is subtracted from the cost of goods available for sale to find the cost of goods sold for the period.

Example

A business had an opening inventory of $20,000 at January 01. It made purchases of $5,000, $6,000 and $3,000 in February, March and May respectively. The closing inventory valuation was $10,000 at June 30. The cost of goods sold can be calculated as follows:

Conclusion

The periodic inventory system is one of the two widely used mechanisms for keeping track of inventories. In this system purchases during the period are recorded in a temporary account and at the end of the period, added to the opening inventory to calculate the cost of goods available for sale. At the end of the period, closing inventory is also physically counted and then valued. This closing inventory is then subtracted from the cost of goods available for sale to find the cost of goods sold.

Pingback: What is perpetual inventory system? - Accounting Hub